Stay informed with free updates

Simply sign up to the UK interest rates myFT Digest — delivered directly to your inbox.

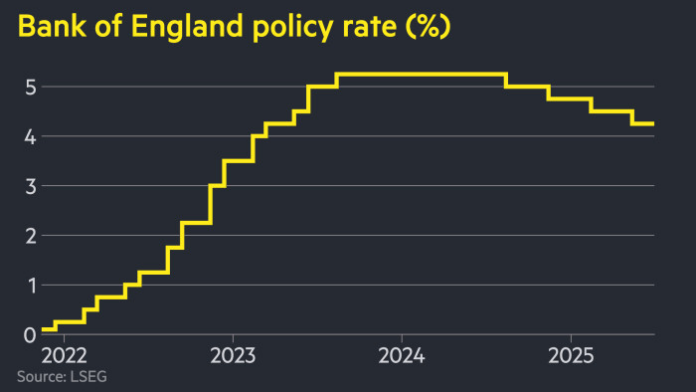

The Bank of England has held interest rates at 4.25 per cent but signalled a possible cut as soon as August after recent data showed a weakening jobs market.

The six-to-three vote by the Monetary Policy Committee followed a quarter-point cut in May amid concerns over the impact of US President Donald Trump’s aggressive tariff policy.

“Interest rates remain on a gradual downward path, although we’ve left them on hold today,” said Andrew Bailey, the BoE’s governor.

Thursday’s widely expected decision came as policymakers wrestle with persistently strong inflation and the additional uncertainty posed by the escalating conflict between Israel and Iran, and its potential impact on oil prices.

“The world is highly unpredictable,” Bailey added, adding that the central bank would pay careful attention to the impact on inflation of the weak labour market.

Deputy governor Dave Ramsden joined external MPC members Swati Dhingra and Alan Taylor in calling for an immediate further cut in rates to 4 per cent.

Gordon Shannon, a fund manager at TwentyFour Asset Management, said the voting pattern was “marginally more dovish” than investors had been expecting.

The MPC predicted a “significant slowing” in pay growth, a sign that another rate cut will be on the table as soon as its August 6 meeting, while also noting that “underlying UK GDP growth appears to have remained weak”.

A report from the BoE’s network of regional agents found business hiring intentions to be “mildly negative” as companies in sectors including manufacturing, retail and construction warned they were not expecting much improvement in customer demand until 2026.

The MPC acknowledged that problems with the UK’s labour market data continued to be a concern, but noted that May’s 109,000 fall in the UK’s official estimate of payrolled employees was the largest monthly contraction since May 2020.

It added that an internal BoE measure suggested a “subdued rate of near-zero employment growth”.

“Labour market developments suggest that the economy is weakening faster than expected,” said Tomasz Wieladek, chief European economist for fixed income at asset manager T Rowe Price.

Earlier this week, data from the Office for National Statistics showed UK consumer price inflation for May at 3.4 per cent, well above the BoE’s 2 per cent target. The central bank expects CPI inflation to remain just under 3.5 per cent for the rest of the year, with a brief rise to 3.7 per cent in September.

The pound was flat against the dollar at $1.341 after the MPC’s decision.

Traders kept their bets on further rate cuts largely unchanged, expecting two quarter-point reductions by the end of the year, according to levels implied by swaps markets.

The BoE emphasised that policy was not on a preset path, adding that it was closely watching “elevated” inflation expectations.

As the worsening conflict in the Middle East risks pushing oil prices higher, the MPC said it would remain “sensitive to heightened unpredictability in the economic and geopolitical environment”, noting recent increases in energy costs.

The BoE reiterated its existing guidance that it would take a “gradual and careful” approach to future rate reductions, which investors have interpreted as pointing towards quarterly cuts.

Additional reporting by Ian Smith