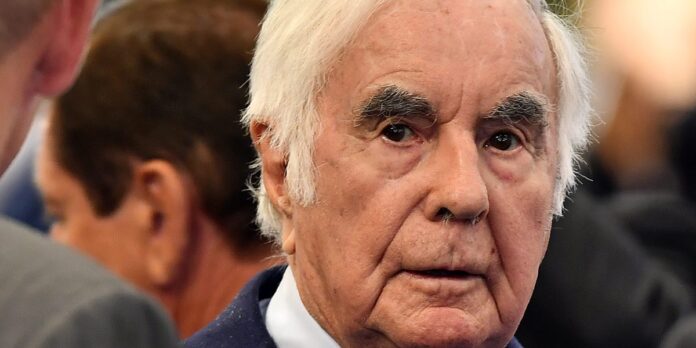

An increasingly acrimonious dispute over the direction of French billionaire Pierre Castel’s drinks conglomerate burst into full public view after a pair of heirs demanded the group CEO’s resignation and organized a vote aimed at ousting him.

Romy Castel, daughter of the 99-year-old founder, and Alain Castel, his nephew, told Bloomberg News they deeply disagree with the way Chief Executive Officer Gregory Clerc is running the wine and beer conglomerate and the power they say he’s amassed.

Clerc “is attempting to take control,” Romy Castel, 51, said in a telephone interview, referring to a move by the CEO earlier this month to remove Alain Castel from two company boards.

In a separate statement, Alain Castel, 65, questioned Clerc’s strategic vision and ability to effectively run the group, which has a workforce of 43,000.

“For me and my family, it has become vital that Mr. Clerc fully appreciate the situation and realize that his resignation is the best solution,” he said.

The closely held Castel Group, which had sales of about €6.5 billion ($7.6 billion) last year from its globe-spanning wine, beer and agricultural operations, has been torn in recent months by internal strife that has pitted key members of the family against Clerc. As the first outsider to oversee operations within the secretive empire, the dispute highlights the risks of generational change within family-controlled companies.

In a statement, the eponymous Castel Group said that Clerc rejects the family members’ claims and added that he remains focused on his mandate to develop and grow the company “within a framework of demanding and responsible governance.”

The website of another company in the group, Castel Afrique, posted a message saying that the board of Castel Group had met in Luxembourg on Dec. 11 and backed Clerc.

The acrimony is escalating at a time when the founder’s health has been faltering. Pierre Castel remained the public face of the businesses until a few years ago, and Clerc was named CEO in 2023 after serving as the founder’s tax lawyer in Switzerland.

The extent of the Castel fortune and the group’s labyrinthine corporate structure came to light through a tax dispute that the billionaire lost on appeal. A Swiss federal court ruled in a July 2023 decision that the businessman had evaded taxes as a longstanding resident in the country. Castel was fined more than €350 million.

Tax Probe

While the Swiss legal procedure is over, a tax probe by French authorities is ongoing, according to Romy Castel.

The power struggle within the conglomerate surfaced earlier this month when Alain Castel, who heads the wine arm of the group, Castel-Vins, said he was removed from the board of a Luxembourg-based holding company, D.F. Holding, as well as Cassiopee Pte. Ltd., a Singapore-based entity that is higher up in the corporate structure. Clerc has seats on both boards.

D.F. Holding is wholly owned by Cassiopee, which is ultimately controlled by Investment Beverage Business Fund, also in the city state.

In his statement, Alain Castel said “deep disagreement” with Clerc has been simmering since his arrival as CEO, adding that one trigger was a survey carried out that he claims hurt a number of projects.

Romy Castel said she has convened an extraordinary general meeting in Singapore on Jan. 8 of Investment Beverage Business Management, or IBBM, the fund management vehicle, to seek Clerc’s removal as director.

A recent filing for that company lists Romy Castel, a French national based in Switzerland, as a shareholder, alongside another of her father’s nephews, Michel Palu. The other shareholders on the list are from outside the family: Two former longstanding French executives, Guy de Clercq and Gilles Martignac, as well as CEO Pierre Baer.

Alain Castel described Romy as a “majority shareholder” of IBBM. The filing shows her having a 24% stake.

With the two former executives as allies “I have the majority,” to remove Clerc, Romy Castel said in the interview. “I am very, very confident.”

Pierre Castel’s empire spans the wine business that started in France and includes chateaus, vineyards, the Nicolas brand of stores and online seller Vinatis. The much bigger brewing and soda operation is focused on Africa, with some 61 brands of beer.

D.F. Holding, which includes both beer and wine operations, reported sales of €6.5 billion in 2024, little changed from the year before. Dividends paid to shareholders rose about eight-fold to €350 million compared with €43 million.

Since Clerc came on board, the firm has consolidated results across a swath of Castel operations. These include factories in 22 African countries as well as sugar plantations, flour and distillery activities.

This year it warned about lower wine consumption in France, political tension in a number of African countries and the war in Ukraine.