Digital distributor Too Lost has made another significant investment in an independent company.

Too Lost is backing AntiFragile Equity Partners, a startup founded in 2024 that acquires and monetizes ‘undervalued’ music rights catalogs, with a “seven-figure” investment.

The deal (worth between $1 million and over $9 million) combines Too Lost‘s distribution infrastructure with AntiFragile’s catalog acquisition model.

The AntiFragile investment follows Too Lost’s recent “seven-figure” investment in Rebellion Records, an independent label founded in 2023.

AntiFragile Equity Partners says that it targets master recordings and publishing rights from mid-tier artists with established fanbases but unrealized streaming and sync potential.

The company uses playlist campaigns, social media advertising, and AI-driven analytics to increase revenue from its catalog holdings, sometimes achieving double or triple-digit growth.

Tom Sarig, who founded AntiFragile Equity Partners, brings 28 years of music industry experience to the venture. His career spans a decade in A&R at major labels including MCA/Universal, TVT Records, Arista Records, and A&M Records; 12 years running management company Esther Creative Group, where his roster included Lou Reed, Bryan Ferry, Violent Femmes, and CAKE; and since 2017, operating independent label AntiFragile Music and publishing company SarigSongs.

“This investment isn’t just capital. It’s strategic rocket fuel that brings us closer to our mission: unlocking value from overlooked music rights and delivering elevated returns to creators and investors alike.”

Tom Sarig, AntiFragile Equity Partners

SarigSongs represented artists including Cannons, Mipso, Jake Isaac, Fox Stevenson, Jamie Drake and more.

Commenting on Too Lost’s investment, Sarig said: “We’ve admired what Too Lost has built from the ground up: artist-first, tech-native, and fiercely independent.

“This investment isn’t just capital. It’s strategic rocket fuel that brings us closer to our mission: unlocking value from overlooked music rights and delivering elevated returns to creators and investors alike.”

The investment will fund expansion of AntiFragile’s acquisition pipeline and bolster its streaming and sync marketing operations.

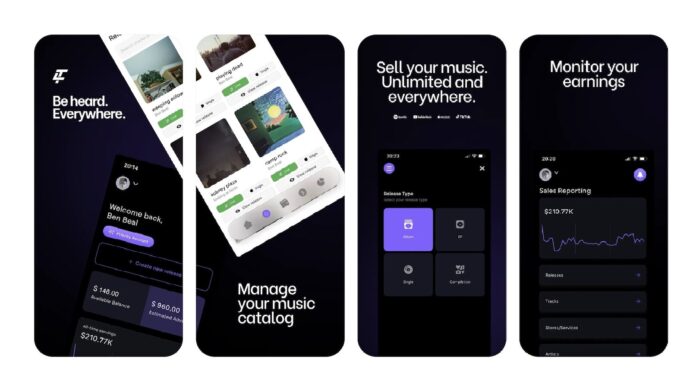

Too Lost launched in 2020 and now serves more than 400,000 artists and labels, distributing over 7 million songs to about 450 digital service providers including Spotify, Apple Music, and TikTok.

“AntiFragile is building something we deeply believe in: a new kind of music IP investment company focused on the long tail, not the top 1%.”

Gregory Hirschhorn, Too Lost

It operates from New York City with additional offices in Los Angeles and Reykjavík. Too Lost was recognized on the 2025 Inc. 5000 list of fastest-growing private companies in America.

The company provides software-as-a-service for independent music rightsholders, handling distribution, monetization and rights protection globally.

Gregory Hirschhorn, CEO of Too Lost, said: “AntiFragile is building something we deeply believe in: a new kind of music IP investment company focused on the long tail, not the top 1%.”

Added Hirschhorn: “Tom has an incredible track record, and we’re excited to back his vision of empowering artists and catalog owners in the new music economy.”

Elsewhere, last month, Too Lost partnered with direct-to-fan platform EVEN, integrating the latter company’s commerce infrastructure directly into Too Lost’s dashboard, allowing artists to sell music, content, merchandise, tickets, and exclusive experiences directly to superfans.

Music Business Worldwide