The housing market is long been seen as an early warning sign for recessions, and one data point in particular has caught the attention of Moody’s Analytics chief economist Mark Zandi.

In social media posts on Sunday, he noted that Moody’s own leading economic indicator that uses machine learning has estimated the odds of a recession in the next 12 months are now at 48%.

Even though it’s less than 50%, Zandi pointed out that the probability has never been that high previously without the economy eventually slipping into a downturn.

A crucial component in the Moody’s indicator comes from the housing market.

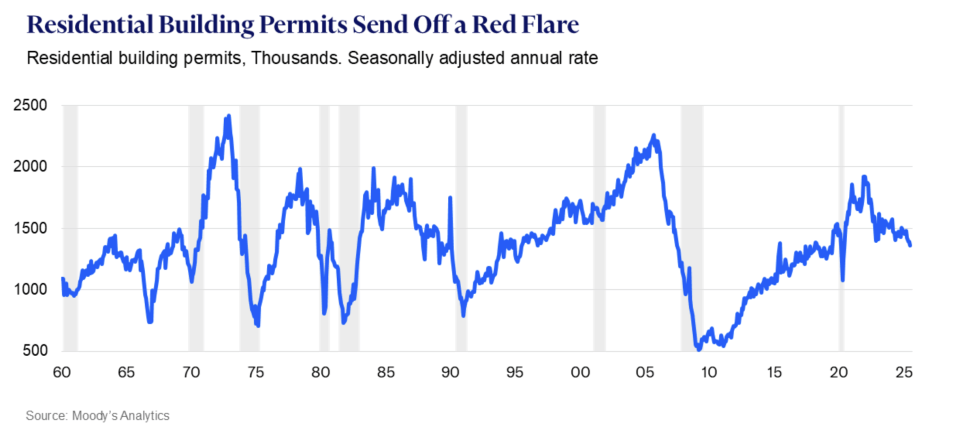

“The algorithm has identified building permits as the most critical economic variable for predicting recessions. And while permits had been holding up reasonably well, as builders supported sales through interest rate buydowns and other incentives, inventories of unsold homes are now high and on the rise,” Zandi warned.

“In response, builders are pulling back, and permits have started to slump. They are now as low as they’ve been since the pandemic shutdowns.”

Last month, the Census Bureau reported that residential building permits in July were at a seasonally adjusted annual rate of 1.35 million, down 2.8% from the prior month and down 5.7% from a year ago.

In July, Zandi singled out the housing market for concern, escalating it to a “red flare” as home sales, homebuilding, and house prices were getting squeezed by elevated mortgage rates.

While the 30-year fixed rate has since come down from near 7% to about 6.3%, it’s not clear yet if that’s low enough to revive builders or how much it will continue to drop. On Sunday, Zandi said all eyes should be on August permit data, which will come out on Wednesday.

“They are sure to provide another reason why the Fed should and will announce a rate cut later that day,” he predicted.

In fact, Federal Reserve policymakers have already started worrying about the housing market. Minutes from the central bank’s July meeting revealed concerns about weak housing demand, rising supply, and falling home prices.

And not only did housing show up on the Fed’s radar, officials flagged it as a potential risk to jobs, along with artificial intelligence technology.

“In addition to tariff-induced risks, potential downside risks to employment mentioned by participants included a possible tightening of financial conditions due to a rise in risk premiums, a more substantial deterioration in the housing market, and the risk that the increased use of AI in the workplace may lower employment,” the minutes said.

Permits aren’t the only housing market data point to follow. The economist Ed Leamer, who passed away in February, famously published a paper in 2007 that said residential investment is the best leading indicator of an oncoming recession.

On that score, the data doesn’t look good either. In the second quarter, residential investment tumbled 4.7%, accelerating from the first quarter’s 1.3% decline.